Face Qian Huangru why to serve as

11'1''

160

East is broadband

Face Qian Huangru why to serve as

Pack up

Face Qian Huangru why to serve as

The university entrance exam is not " take an examination of calm lifelong " Ying Tan is faced like that start leisurely

Adolescent affection criminalistics is born not to avoid youth loves a calm to face dispute

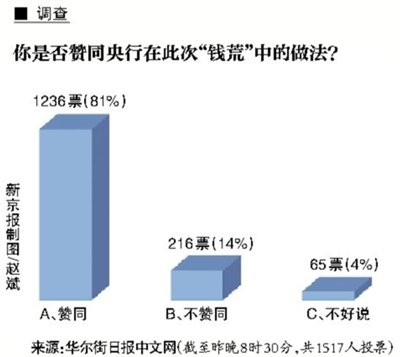

New capital signs up for dispatch (reporter Shen Wei is green) to course of study of this round of Bank of China alleged " Qian Huang " , intermediary also gave great attention outside, mainstream media thinks generally, this " Qian Huang " it is Central Bank meaning the credit dimensions in excessive to the bank dilate and the shadow bank system that expand increasingly with caution; In the meantime, state of insecurity of fluidity of this round of provisionality can not last too long, the risk can accuse. Economist and analyst still value Chinese market prospect.

Dissolve the venture that the bank accumulates

" wall street daily " say, the administrative layer that is China directed this " Qian Huang " , meaning a lesson gets in the financial orgnaization that makes management of one part fluidity radical, this is bank of Chinese government keep within limits incontinent put borrowed move.

BBC expresses, "Qian Huang " the phenomenon announced the essential sex predicament that Chinese bankwatch case manufacturering system faces. On one hand financial system of China liberalizes degree is insufficient still, deposit interest rate still is controlled strictly by the government, on the other hand the loan of the bank extends however " unbridled " , credit increase rate exceeds 20% . If credit bubble is a time bomb, so governmental urgent affairs is demolish fusee and not be to detonate bomb.

" financial times " also say, the misgivings of Chinese Central Bank assist footing appears to make clear, china is new the financial venture that a leader is determined to dissolve domestic bank system to be accumulated in recent years, although cause economy,put delay quickly also will not grudge.

The analyst values market prospect

" wall street daily " the report shows, this strong position has been opposite the govnorth face shirtsernment temporary inhibition arrived since shadow bank. The report says, in bank fluidity insecurity the influence falls, the China that spends composition of inferior informal finance orgnaization with superintending Cheng with etc all right by the trust company, insurance company, company that rent, hock " shadow bank " the near future also appeared to put delay apparently. Say according to a research organization, because fluidity insecurity shook,investor sends the confidence of debt substance to high risk, domestic trust company contracted to invest the emission of the product.

Also have analytic concern, fluidity insecurity or to finance economic domain spreads beyond course of study, bring the consequence that expect is less than.

Reuter says, the stock market that steep fall and continuously turbulent money market also lets appear on the stage apparently before long new government faces enormous pressure, administrative layer otherwise wants commentate the signal that gives exciting economic policy in order to stabilize market confidence, it is a choice of be in a dilemma.

" Forbes " the records shows, although look from stock market prices, the market is not strong to the confidence of policy constitutor, but economist and analyst are valued however. Repormodern dining chairstorial cite installs stone to invest an analyst brief·Enlighten the word of favour says, chinese government shouldspring pool want only, capable to be in any moment to fluidity of infuse of the market between the bank in order to end " Qian Huang " .

■ viewpoint

What become Anacreontic at present is, china is new an economy leading group is willing tnorton internet antiviruso bear certain and short-term anguish, in order to exchange long-term gains. the best selling north face shirts

—— broken bits hits grand of annals of bank economist king

Chinese government can alleviate a little fluidity, before undertaking acting next, watch period of time first. According to governmental manner, short-term and constrictive will still last. And the interest rate between the bank also needs for sombrass faucete time to just be able to return to normal.

—— star exhibits area of bank big China Liang Zhaoji of advanced economy division

5 years credit dilate was pushed in the past tall financial venture, cannot rely on to raise free modern dining chairsinterest rate only when solving this one problem, still need macroscopical with the policy of microcosmic level combination changes leasehold behavior and bank balance sheet. Squash blindly fluidity may cause money market wave motion.

Whole world of —— beautiful banner is presiding economist Williams·Cloth is special

■ relevant

Mark general: Bank fraction defective or rise to 3%

New capital signs up for dispatch (reporter Shen Wei is green) Er of general of grade orgnaization standard holds telephone meeting yesterday, liao Jiang of analyst of this orgnaization credit expresses, at present the fluidity between nervous bank will put the credit growth of delay China, because activity of the market between the bank decreases, it still can pound the gain ability of the bank with those fluidity radical management. Because credit environment is more nervous, the bad assets problem of a few enterprises will be exposed, this will make banking fraction defective rises to this year 3% the left and right sides.

Data shows, up to go when the end of the year, bad loan rate is orgnaization of finance of trade of Bank of China 1.56% , drop compared to the same period 0.22 percent. Liao Jiang expresses, compare all the time as a result of environmentharrison hotthe best selling watch cases spring weather forecast of the credit before this comfortable, obscured the asset quality issue of partial enterprise. Go to what lever changes spreading out as banking, credit is contractive, the business that those cannot get in time borrowing money may appear break a contact, make the asset quality of the bank also is affected thereby.

But he expresses at the same time, current and temporary fluidity insecurity state will get alleviating basically in next month, appear unlikelily a run on a bank even the phenomenon that the bank closes down.

No comments:

Post a Comment